18 health technologies poised for big growth

By now, everyone's got an EMR. And most providers are also making use of ancillary technologies to help harness patient data toward more efficient care and better outcomes. But many species of health IT are still surprisingly underused in the U.S. hospital market.

"While the EMR market itself is pretty saturated, and usage has really improved since the HITECH Act, the challenge for hospitals and health systems is, now that you have all this data, what do you do with it?" says Matt Schuchardt, director of market intelligence solutions sales at HIMSS Analytics.

There's no shortage of technologies out there to help hospitals improve operations. But it may surprise you to realize how relatively untapped they often still are.

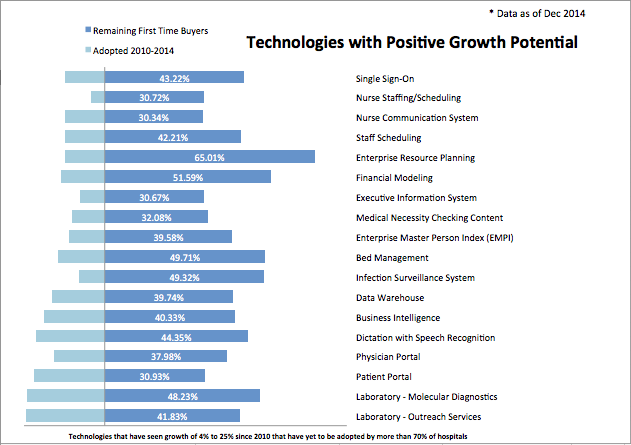

HIMSS Analytics' hospital database keeps tabs on all manner of IT products, and its list of the tools with biggest positive growth potential points to where the market will be heading in the coming years.

It tracks technologies that have seen growth of 4 percent to 10 percent since 2010 – but have yet to be adopted by more than 70 percent of hospitals. In many cases, the percentage of potential customers far exceeds those that have a given product installed.

The reasons for this are varied, says Schuchardt. In some cases, the tools have just recently become sufficiently well-developed to make a difference. Some are still fairly new technologies. Some are more sophisticated than smaller hospitals really need. Some require significant shifts in strategy and workflow, and providers may not yet be willing to take the plunge.

But all offer the potential to help achieve the big goals: better care for more people at lower cost.

"I think the opportunity for vendors to provide solutions is now," he says. "There are technologies in place now that can really help, and hospitals need to be aware of them."

With EMRs by now well-established, he adds, "the next step of optimization is going to require analysis and utilization of all these large data sets, and really clear insights on best practices."

We asked Schuchardt to weigh in on the HIMSS Analytics list, offering his thoughts on the potential of each.

Bed Management

Remaining first-time buyers: 49.7 percent

It's surprising to think how few hospitals "know how their beds are used, and where they're in use," says Schuchardt. "Think about how expensive beds are getting: you have to staff them, of course, but the beds themselves are extremely expensive and you can't have them be empty." As such, "this is one technology that "has big growth potential." New software programs "are so much more sophisticated in terms of the data they're tracking," he says. "Knowing how many beds are empty, most hospitals probably do that on a spreadsheet. But really knowing how they're utilized – and which beds are the most expensive – is going to be incredibly helpful, in terms of the cost-cutting and savings people are hoping to get from these structural changes."

Business Intelligence

Remaining first-time buyers: 40.3 percent

Financial BI is fairly well-used, at least at larger institutions. But "clinical BI is still very lightly adopted, and there are lots of plans to purchase those tools," says Schuchardt. "You need the data, but once you have it, what do you do with it? You're going to need a tool to really analyze it. BI connects really well to population health, too: Population health is a series of components – it's integrating all those disparate data sets together to make the right decisions for patient care and from a business perspective."

Data Warehouse

Remaining first-time buyers: 39.7 percent

An EMR, too, is a series of components, "with a clinical data repository being the hub of that spoke," he says. But in its most basic form that only means the data inside that system – "it's not all of the external data that's available – pay data, etc. You need all of that to really start doing BI." That's a massive amount of data that needs a place to live and a means with which to be fed into clinical and business intelligence platforms. And that's saying nothing of all the new data sources emerging onto the scene. "Now there are intelligent medical devices that are able to load your blood pressure into your record when you're at the hospital or the doctor's office," says Schuchardt. "There's a ton, a ton, a ton of data, and machine learning is going to start letting us make hay of that sooner, rather than later – but only if you have access to that kind of processing power."

Dictation with Speech Recognition

Remaining first-time buyers: 44.4 percent

"This is another one where it's just a technology issue," he says, suggesting that many hospitals just have other competing priorities for their tech budgets. But the capabilities exist. "You can have Dragon at your house now. Everyone has Siri on their phone, although she's not very smart. You think about the kinds of words people use in healthcare it just increases the complexity. It's not, 'Hey, how do I get to here…' It's very technical and jargony – you need to make sure there aren't translation errors."

Enterprise Master Person Index

Remaining first-time buyers: 39.6 percent

"EMPI is sort of like the next level of CDR," says Schuchardt. "It's like putting patient data in an easily sharable manner. The data sets in different EHRs aren't even necessarily correlatable. One may have your birthday as three fields and another might have it as an eight-digit code. Those two data sets are never going to talk. In that format, they're going to say, this isn't the same person – or you're going to have to build a very complicated query to connect those two data sets. It's getting to some standardization across vendors, and making the data much more sharable. Or allowing you to pull data into the EMPI as an interim step between connecting a physician office that's on one EMR to a hospital that's on another."